The Bank of Canada announced this  morning that it is maintaining its target for the overnight rate at 1 per cent. In the press release accompanying the decision, the Bank noted that inflation has edged up slightly and is expected to return to its target of 2 per cent in the second half of 2018 while economic growth is forecast to slow in the final six months of this year following a very strong first half.

morning that it is maintaining its target for the overnight rate at 1 per cent. In the press release accompanying the decision, the Bank noted that inflation has edged up slightly and is expected to return to its target of 2 per cent in the second half of 2018 while economic growth is forecast to slow in the final six months of this year following a very strong first half.

The Bank emphasized that it will be cautious in making future adjustments to its policy rate as it assesses the sensitivity of the economy to higher interest rates.

There are several factors influencing the Bank’s decision to move to the sidelines. Recent economic data points to a slowing of growth from the soaring heights of the first half of 2017. Moreover, inflation remains muted and newly announced tightening of mortgage regulations will have a significant impact on households, particularly in a rising mortgage rate environment. We expect that the Bank will take a wait and see approach over the next few months as the impact of its previous rate tightening takes hold.

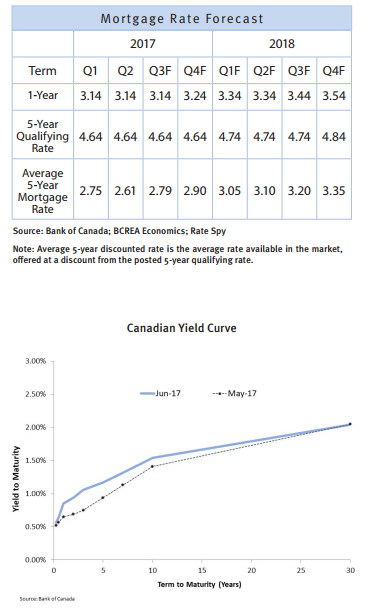

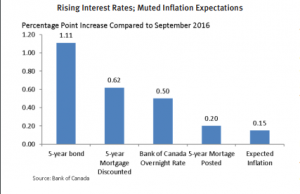

Since our second quarter forecast, our projected rise in mortgage rates has occurred and accelerated, as the Bank of Canada—spurred by economic growth that far exceeded its outlook—turned suddenly hawkish. The Bank surprised with a 25-basis point increase in July and then again in September, taking its overnight rate back to 1 per cent, where it was before the precipitous drop in oil prices that shocked the Canadian economy in 2014. After the July interest rate hike, markets widely expected at least one additional rate increase in the fall, and so bond markets and lenders had already priced in the September increase by the time it occurred.

Since our second quarter forecast, our projected rise in mortgage rates has occurred and accelerated, as the Bank of Canada—spurred by economic growth that far exceeded its outlook—turned suddenly hawkish. The Bank surprised with a 25-basis point increase in July and then again in September, taking its overnight rate back to 1 per cent, where it was before the precipitous drop in oil prices that shocked the Canadian economy in 2014. After the July interest rate hike, markets widely expected at least one additional rate increase in the fall, and so bond markets and lenders had already priced in the September increase by the time it occurred.

TheBritish Columbia Real Estate Association (BCREA) released its 2017 Third Quarter Housing Forecast update today.

TheBritish Columbia Real Estate Association (BCREA) released its 2017 Third Quarter Housing Forecast update today. The British Columbia Real Estate Association (BCREA) reports that a total of 9,275 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in July, down 6.3 per cent from the same period last year. Total sales dollar volume was $6.48 billion, down 1.3 per cent from July 2016. The average MLS® residential price in the province was $698,761, a 5.3 per cent increase from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,275 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in July, down 6.3 per cent from the same period last year. Total sales dollar volume was $6.48 billion, down 1.3 per cent from July 2016. The average MLS® residential price in the province was $698,761, a 5.3 per cent increase from the same period last year.