The Bank of Canada announced this morning that it is raising its target for the overnight rate by 25 basis points to 0.75 per cent. In the press release accompanying the decision, the Bank noted that Canada’s economy has been robust and a significant amount of economic slack has been absorbed. While inflation data has been soft, the Bank expects that this is temporary and that inflation will return to its 2 per cent target by mid-2018.

The Bank of Canada announced this morning that it is raising its target for the overnight rate by 25 basis points to 0.75 per cent. In the press release accompanying the decision, the Bank noted that Canada’s economy has been robust and a significant amount of economic slack has been absorbed. While inflation data has been soft, the Bank expects that this is temporary and that inflation will return to its 2 per cent target by mid-2018.

The motivation for today’s rate increase seems primarily to be that the Bank feels that the stimulus it injected into the Canadian economy in 2015 through two rate cuts is no longer required given a recent trend of strong economic and employment growth. If that is the case, a further 25 basis point increase before the end of the year will likely follow. After that, the pace of rate increases relies heavily on the trend in Canadian inflation, which to date has been well below the Bank’s 2 per cent target. If that trend does not reverse by early next year, the Bank may decide to stop at a 1 per cent overnight rate until higher inflation emerges.

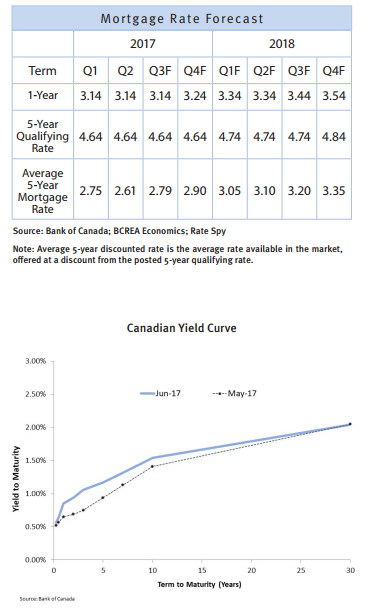

As bond markets reprice rate expectations, Canadian mortgage rates have returned to levels observed at the beginning of the year. We expect that mortgage rates will rise further in the second half of 2017, finishing near 3 per cent for a five-year fixed rate.

For more information, please contact:

| Cameron Muir | Brendon Ogmundson |

| Chief Economist | Economist |

| Direct: 604.742.2780 | Direct: 604.742.2796 |

| Mobile: 778.229.1884 | Mobile: 604.505.6793 |

| Email: cmuir@bcrea.bc.ca | Email: bogmundson@bcrea.bc.ca |