Effective January 1, 2018, first-time home buyers who don’t require mortgage insurance — those with a down payment of 20 per cent or more — must qualify for their mortgage at a higher rate.

Effective January 1, 2018, first-time home buyers who don’t require mortgage insurance — those with a down payment of 20 per cent or more — must qualify for their mortgage at a higher rate.

This new stress test won’t apply to people renewing their uninsured mortgage.

Canada’s Office of the Superintendent of Financial Institutions (OSFI) announced these rule changes today. Draft changes were released in the summer for public feedback. (The Canadian Real Estate Association submitted this response to the draft rules in August on behalf of REALTORS® across the country.)

Under the new rules, the minimum qualifying rate for uninsured mortgages will be the greater of the Bank of Canada’s five-year benchmark rate or the contractual mortgage rate plus two per cent.

OSFI will also require lenders to enhance their loan-to-value (LTV) limits and restrict certain lending arrangements designed to circumvent LTV limits.

These changes apply to all federally regulated financial institutions.

This is the seventh time since 2008 that the federal government has made mortgage policy changes.

Read the government’s full announcement here.

Economic analysis from the BC Real Estate Association (BCREA):

“The impact of the new stress test requirement will be to lower the purchasing power of households by up to 20 per cent. Like past tightening of mortgage regulations, we anticipate that the market impact will be sharp but temporary. In the past, we’ve seen home sales decline in the three to nine months following the implementation of tighter mortgage lending standards, with the severity of the impact fading within one year. However, these new regulations impact a larger pool of mortgages and so the impact could be more significant than in the past,” said Cameron Muir, BCREA chief economist

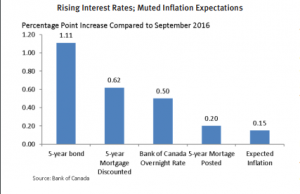

Since our second quarter forecast, our projected rise in mortgage rates has occurred and accelerated, as the Bank of Canada—spurred by economic growth that far exceeded its outlook—turned suddenly hawkish. The Bank surprised with a 25-basis point increase in July and then again in September, taking its overnight rate back to 1 per cent, where it was before the precipitous drop in oil prices that shocked the Canadian economy in 2014. After the July interest rate hike, markets widely expected at least one additional rate increase in the fall, and so bond markets and lenders had already priced in the September increase by the time it occurred.

Since our second quarter forecast, our projected rise in mortgage rates has occurred and accelerated, as the Bank of Canada—spurred by economic growth that far exceeded its outlook—turned suddenly hawkish. The Bank surprised with a 25-basis point increase in July and then again in September, taking its overnight rate back to 1 per cent, where it was before the precipitous drop in oil prices that shocked the Canadian economy in 2014. After the July interest rate hike, markets widely expected at least one additional rate increase in the fall, and so bond markets and lenders had already priced in the September increase by the time it occurred.

Over the past 12 months, the 5-year bond yield has risen 110 basis points to a three-year high of close to 1.8 per cent, prompting a 60-basis point increase in 5-year discounted mortgage rates to above 3 per cent for the first time since 2014. The 5-year qualifying rate has risen just 20 basis points to 4.84 per cent. The latter is an interesting development, because it is the first increase in the posted rate since stricter qualifying rules for insured mortgages were imposed last fall. Rising mortgage rates may complicate the introduction of further mortgage qualifying restrictions slated for October, this time tightening lending for uninsured mortgages.

We anticipate that the Bank of Canada will hold off on further rate increases this year and assess how higher rates are impacting the economic and inflation outlook. However, in the Bank’s recent communications, it has very clearly left the door open for more aggressive tightening should the current torrid pace of economic growth continue. Our baseline forecast is for the 5-year fixed mortgage rate offered by lenders to average 3.15 over the fourth quarter, eventually rising to 3.44 by the end of 2018. The posted 5-year qualifying rate is forecast to reach 5.14 per cent by the end of next year.

For the complete news release, including detailed statistics, click here.