Click here to view the latest Stats Centre Report for Vancouver East.

Click here to view the latest Stats Centre Report for Vancouver West.

The Bank of Canada held interest rates at 0.5 per cent Wednesday with an assessment of the economy which has some positives tempered with risks.

The Bank of Canada held interest rates at 0.5 per cent Wednesday with an assessment of the economy which has some positives tempered with risks.

Governor Stephen Poloz said that while the economy is adjusting to lower oil prices and inflation is broadly in line with expectation, it expects growth in the second quarter to moderate from the first.

The bank is still closely watching high levels of household debt and rising house prices but noted that consumer spending and debt levels are robust and that is spreading broadly across regions.

Macroprudential and other policy measures, while contributing to more sustainable debt profiles, have yet to have a substantial cooling effect on housing markets, the bank said.

In its assessment of the BoC’s announcement, the Conference Board of Canada highlighted the ongoing risk of protectionism and the imbalances in real estate values and rising household debt.

“The subdued pace of inflation and uncertainties stemming from global and domestic risks has the Bank of Canada in wait-and-see mode. The next move in interest rates is likely upwards, but this may not come until early next year.

By then, there will be a greater understanding of how the risks may play out,” said Craig Alexander, Senior Vice-President and Chief Economist, The Conference Board of Canada.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,865 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in April, down 23.9 per cent from the same period last year. Total sales dollar volume was $7.19 billion, down 25.4 per cent from April 2016. The average MLS® residential price in the province was $728,955, a 2 per cent decrease from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,865 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in April, down 23.9 per cent from the same period last year. Total sales dollar volume was $7.19 billion, down 25.4 per cent from April 2016. The average MLS® residential price in the province was $728,955, a 2 per cent decrease from the same period last year.

“BC home sales are on an upward trend this spring, led by a sharp increase in consumer demand in the Lower Mainland,” said Cameron Muir, BCREA Chief Economist. The seasonally adjusted annual rate (SAAR) of home sales was over 106,000 units in April, significantly above the five-year SAAR for April of 89,000 units.

The supply of homes for sale declined 17 per cent from April 2016. On a seasonally adjusted basis, active residential listings have declined 50 per cent since 2012 and are now at their lowest level in over 20 years. The imbalance between supply and demand is continuing to drive home prices higher in most regions, further eroding affordability.

Year-to-date, BC residential sales dollar volume was down 31.8 per cent to $21.3 billion, when compared with the same period in 2016. Residential unit sales declined 25.0 per cent to 30,757 units, while the average MLS® residential price was down 9.2 per cent to $692,220.

For the complete news release, including detailed statistics, click here.

Demand for condominiums and townhomes continues to drive the Metro Vancouver* housing market.

Residential property sales in the region totalled 3,553 in April 2017, a 25.7 per cent decline compared to April 2016 when 4,781 homes sold and a 0.7 per cent decrease from the 3,579 sales recorded in March 2017.

April sales were 4.8 per cent above the 10-year average for the month.

For the first four months of the year, condominium and townhome sales have comprised a larger percentage of all residential sales on the Multiple Listing Service® (MLS®) in Metro Vancouver. Over this time, they’ve accounted for 68.5 per cent, on average, of all residential sales. This is up 10 per cent from the 58.2 per cent average over the same period last year.

“Our overall market is operating below the record-setting pace from a year ago and is in line with historical spring levels. It’s a different story in our condominium and townhome markets,” Jill Oudil, Real Estate Board of Greater Vancouver (REBGV) president said. “Demand has been increasing for months and supply is not keeping pace. This dynamic is causing prices to increase and making multiple offer scenarios the norm.”

New listings for detached, attached and apartment properties in Metro Vancouver totalled 4,907 in April 2017. This represents a decrease of 19.9 per cent compared to the 6,127 units listed in April 2016 and a three per cent increase compared to March 2017 when 4,762 properties were listed.

The total number of residential properties currently listed for sale on the MLS® system in Metro Vancouver is 7,813, a 3.5 per cent increase compared to April 2016 (7,550) and a three per cent increase compared to March 2017 (7,586).

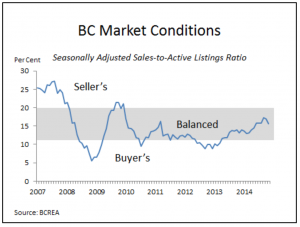

The sales-to-active listings ratio for April 2017 is 45.5 per cent for all property types. This is two per cent below March 2017 and is indicative of a sellers’ market. Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

By property type, the sales-to-active listings ratio is 26 per cent for detached homes, 58.2 per cent for townhomes, and 82.2 per cent for condominiums.

“Until more entry level, or ‘missing middle’, homes are available for sale in our market, we’ll likely continue to see prices increase,” Oudil said. “There’s been record building this past year, but much of that inventory isn’t ready to hit the market.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $941,100. This represents a five per cent increase over the past three months and an 11.4 per cent increase compared to April 2016.

Over the last three months, the benchmark price of condominiums has seen the largest increase in the region at 8.2 per cent, followed by townhomes at 5.3 per cent, and detached homes at 2.8 per cent.

“Home buyers are looking to get into the market and they’re facing fierce competition,” Oudil said. “It’s important to work with your local Realtor to help you navigate today’s marketplace.”

Sales of detached properties in April 2017 reached 1,211, a decrease of 38.8 per cent from the 1,979 detached sales recorded in April 2016. The benchmark price for detached properties is $1,516,500. This represents an 8.1 per cent increase over the last 12 months and a 1.8 per cent increase compared to March 2017.

Sales of apartment, or condominium, properties reached 1,722 in April 2017, a decrease of 18.3 per cent compared to the 2,107 sales in April 2016.The benchmark price of an apartment property is $554,100. This represents a 16.6 per cent increase over the past 12 months and a 3.1 per cent increase compared to March 2017.

Attached, or townhome, property sales in April 2017 totalled 620, a decrease of 10.8 per cent compared to the 695 sales in April 2016. The benchmark price of an attached unit is $701,800. This represents a 15.3 per cent increase over the past 12 months and a 2.4 per cent increase compared to March 2017.

BC Real Estate Association (BCREA) Chief Economist Cameron Muir discusses the August 2015 statistics.

At Downtown Suites we follow the news and statistics from all the professional real estate economists, so we can offer our clients the best market news in keeping with the current trends and most up to date information.

BC Real Estate Association (BCREA) Chief Economist Cameron Muir discusses the November 2014 statistics.

Housing Market Ends Year in Balanced Conditions

Vancouver, BC – December 12, 2014. The British Columbia Real Estate Association (BCREA) reports that a total of 5,972 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in November, up 8.8 per cent from November 2013. Total sales dollar volume was $3.4 million, an increase of 12.1 per cent compared to a year ago. The average MLS® residential price in the province rose to $574,694, up 3.1 per cent from the same month last year.

“BC home sales were robust in November,” said Cameron Muir, BCREA Chief Economist. “Improving economic conditions, strong consumer confidence and persistently low mortgage interest rates are providing a solid foundation for elevated consumer demand.”

“BC home sales were robust in November,” said Cameron Muir, BCREA Chief Economist. “Improving economic conditions, strong consumer confidence and persistently low mortgage interest rates are providing a solid foundation for elevated consumer demand.”

“Market conditions have improved province wide, with most regional markets now in the mid to high range of a balanced market,” added Muir.

Year-to-date, BC residential sales dollar volume was up 22.1 per cent to $44.8 billion, compared to the same period last year. Residential unit sales were up 15.3 per cent to 78,973 units, while the average MLS® residential price was up 6.0 per cent at $567,292.

Link HERE for more details.

As Members of the BCREA, we are grateful for their ongoing reports and statistics keeping us up to date while tracking the Vancouver Real Estate Market.

Featured Listing!

Now $649,000

Heart of Yaletown…the H & H is situated on the corner of Homer and Helmcken.

Steps to all the amenities of this unique area including Canada Line, restaurants, shopping, seawall, stadiums and as Steve Nash Gym close by.

Fine quality finishes throughout including wool carpet and porcelain tile flooring.

Cool kitchen with quality stainless steel appliances, granite and sleek contemporary wood cabinets.

Sunny but covered balcony, large insuite storage. Rooftop common deck and gym.

Tremendous value.

Features: Central location, Recreation nearby, Shopping nearby, View, Marina nearby

MLS® No.:V1031673

2 Bedrooms, 2 Bathrooms

Finished Floor Area:950.0 sqft.

Maintenance:$343.90

Taxes:$2,198.00

Contact Nicholas Meyer today for more info and to view. Call 604-694-8801 or Email nic@downtownsuites.com